The 5 Essential Credit Card Settings To Keep Your Money Safe

Disclaimer: These ramblings are just from what I have experienced helping customers with IT / Banking issues. Definitely NOT financial advice

After seeing numerous customers having their credit cards charged wrongly (sometimes just overcharged and sometimes outright scammed), it has become clear to me that;

1. A great many customers don’t know about these settings and

2. Not all banks, including some of Australia’s so called “big banks“, don’t actually offer these settings

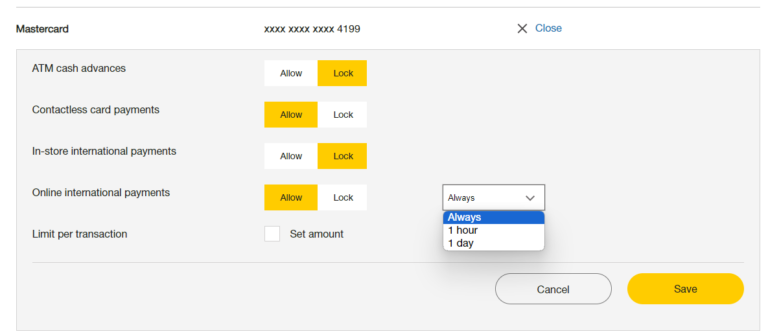

So, here is a list of card settings that you should be able to control. You should be able to switch these settings, On / Off / On (for a period of time and then automatically switch off) that your bank should provide you with, to help protect your credit card.

ATM Cash Advances

This is where you put your card in the ATM, and with the correct PIN can withdraw sums of cash. Cash advances, particularly on credit card, attract high interest from day one, so unless it is an emergency it is advisable to never have this switched on.

Contactless Card Payments

This is where you will “tap and go” or”pay wave” your card, without the need for a PIN (unless over a certain amount). Very convenient, but open to abuse if the physical card falls into the wrong hands. Most people have this switched on with a limit applied.

In-Store International Payments

If travelling overseas, this can be helpful when shopping. When not travelling, this should be able to be turned off to stop a scammer “shopping” with your card.

Online International Payments

Most of our purchases online are processed internationally, sometimes even if it is a local Australian business, as they may use a third party processor based outside of Australia. For this reason I believe this is the most important control over your credit card. It may mean that you have to unlock the setting when you purchase an item off Amazon, eBay or other online retailer, which can be annoying. However, this is better than being told by your bank that $2000 was spent on your card at some nightclub in Rome.

Transaction Limits

Its always good to have a limit on your transactions. If you pay bills regularly, which usually come in at under $100, then a transaction limit of $100 should catch any suspicious transaction of over $100. And if it is you making the transaction, then at least the minor inconvenience of having to change your transaction limit will put your mind at ease that a criminal would not be able to charge over that limit either.

This is what a Commonwealth Bank user will see under Card Settings in Netbank. Disclaimer: Definitely NOT advocating for Commonwealth Bank, just any bank with these protections.

If you are in doubt, Book a PC Security Check with the PC Guy to make sure you are secure.